VAT exemptions for intra-European Union sales

Our products are exempt from VAT for intra-EU sales accompanied by a business invoice from our company to a business or taxable person.

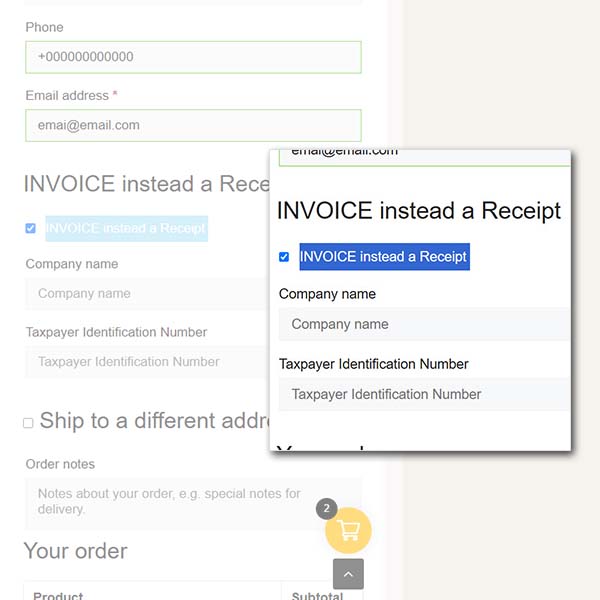

To be eligible for VAT exemption on the products in your order, please provide us with your business tax details in the checkout form, by selecting the “INVOICE instead a Receipt” field.

EU Countries – VAT Exemption

Austria, Belgium, Bulgaria, Croatia, Republic of Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hungary, Ireland, Italy, Latvia, Lithuania, Luxembourg, Malta, Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Spain and Sweden.